Summary

The heart of Celer Network is the CELR token. And the heart of the CELR token is the fees reward. The goal is to increase the volume on the Celer Network to increase the fees pay to it’s stakers. Although stakers also get paid in CELR, this will be capped once the max supply is reached. Increasing the amount of fees paid to stakers will directly increase the utility of the CELR token.

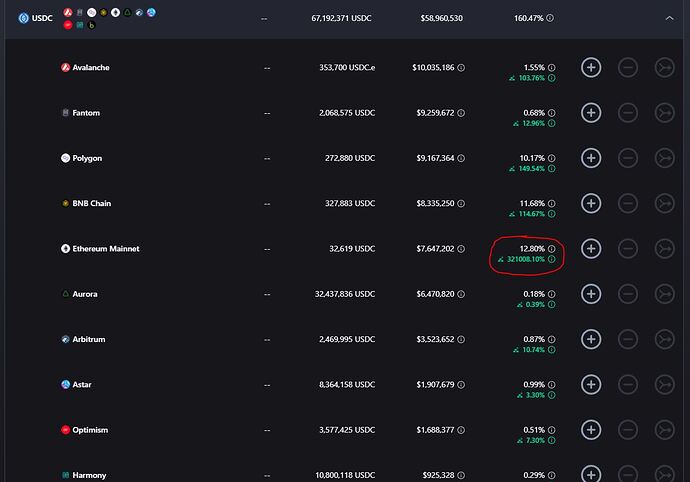

Currently, it is more beneficial to provide liquidity than it is to buy CELR.

Stuff like this should be unacceptable.

We should not be dependent on liquidity providers.

I propose using a portion of fees collected to add liquidity to the pools. I also propose that fees collected should not be paid to liquidity providers (since they are already paid in CELR).

This will continually provide deeper liquidity to the network as the user base grows. It will also eventually phase out liquidity providing dependence. Also more fees will be paid to stakers and less CELR will be paid out to liquidity providers (reducing sell pressure & inflation).

This would of course, happen gradually, as to not discourage liquidity providers to immediately sell. It would also motivate them to buy CELR if they wanted to collect yield.

Motivation

Increasing CELR Utility & adding long term stability

Proposal

5% (or more) of fees collected should be added to the liquidity pool (distributed between pools based on weight).

Providing liquidity should not pay any fees and should be phased out over time.

Poll

What do you think?

- Allocate a portion of fees collected to add liquidity in the pools

- Don’t change anything

0 voters