How are things progressing on Layer2.Finance v1.0?

The development of Layer2.Finance v1.0 is progressing well. Currently, the team is working on L2F smart contract (with new strategy support capability, liquidity mining(yes!), and P2P transfer) is feature complete!

We will take a week (next week) to iron out any issue that our internal team can identify and then on 05/31 two security audits are scheduled to be completed by 06/14. This is also likely going to be the date when we launch the v1.0 testnet.

Similar to what we did with v0.1, we will have a 2-week testnet period and afterwards, we will launch the mainnet, if no issues are identified. Besides that, a new UI and mobile compatibility are also coming!

As more strategies are introduced, more users are likely to engage and park their assets on L2F, and to support the new functionalities in development, we continue to add more engineering resources (with new engineering team members) in accelerating this front.

Next week, we plan to introduce three new strategies for the community to vote and decide whether to include those new strategies or not. The first one is AAVE liquidity farming (quite complicated to do if you are running solo). The second one is stETH and ETH pair on Curve. The third one is a strategy that automatically balances between Compound and AAVE. All three were built by the community.

More info will come as they become available so stay tuned.

Will L2F v1.0 be accompanied by any marketing efforts? And does the current team include a marketing person?

Yes, we have a marketing team. And yes, v1.0 will be accompanied by heavy PR outreaches. And most importantly, liquidity mining, which will drive organic awareness quickly.

Are you going to make the SGN portal mobile responsive as well?

For sure, that’s on the roadmap. Right now the team’s hands are full with L2F v1.0 stuff and once that is released, we will revisit several areas to get them squared away.

Will locking Celer be available in L2F v1.0

With L2F, we will of course engage with different DeFi protocols and communities to have partnerships regarding utilizing CELR in the broader DeFi landscape. It will be a process.

We believe it will be a mutually beneficial relationship: L2F is bringing users that are otherwise not possible to use those DeFi protocols and it makes sense to have CELR as part of the broader DeFi ecosystem.

What are the assumption inputs numerators and denominators that we should be thinking about long term so that we can make our own assumptions about crypto and DeFi to what the value of the coins could be in the future – and how are the value of the coins reflected in the State Guardian Network (SGN)?

State Guardian Network (SGN) is a decentralized L2 service infrastructure. It serves multiple purposes essential to the Celer L2 platform’s smooth operation. First, it serves as a decentralized “watchtower” service that ensures users’ state in the Celer State Channel Network is safely stored and responds to any L1 settlements when users are offline. Second, it serves as a decentralized block producer layer for Celer Rollup to ensure a high level of liveness, incentive-compatible block producer election, and finally an additional layer of security.

Users are required to stake CELR tokens in order to join SGN and earn fees for providing related services.

In addition, CELR acts as a governance token for the protocol upgrades: we will see that soon next week when new strategies are added to L2F.

How long until the Layer2.Finance app will remove its “beta: use at your own risk” message?

This will take some run-in time and I would say DeFi carries inherent risk and the test of time is always needed. I would say some time in Q3, we can lose that tag.

What do you think about security between Celer and Matic, while Matic works the L2 as a sidechain, does Celer leave security to L1 directly? Is Celer’s technology safer in the mid-term?

That is very much correct. Celer’s technology does not rely on any kind of community/PoS nodes. Celer’s State Guardian Network (SGN) is for chain liveness and smooth operation. Not security. Celer’s rollup has the same security as L1.

Celer uses L2 technology where the security relies on and ONLY on layer1. But Matic uses the DPoS side chain as a security layer. That’s the main difference.

Additionally, Celer is also complementary to any of the chain-based solutions, such as Matic, Arbitrum, and Optimism because cBridge and State Channel Network can run on top of all these layer2 and enable smooth and instant value transfer cross-chain and cross-layer.

Who would you say is your strongest competitor in the space?

Well, Celer is taking a bit of a different approach to L2: we are building middlewares, not generic purpose chains. For the State Channel, we don’t see any competitors out there and cBridge v1.0 is in the pipeline to be released in June. For Rollup, our approach of scaling applications is also a bit different from other solutions. We do not require apps to migrate to Rollup but can scale them in place.

I think all scaling efforts are good and will help Ethereum and blockchain adoption in the long run, and Celer is focused on the smooth interoperation and user experience of a multi-layer2 future.

There are complaints about the complexity of UX/UI using Polygon solutions. With Layer2.Finance being a near 1 click solution, this would be solved, am I correct? Security and Simplicity will be key for adoption and migrating people to Celer solutions.

Correct, that’s the goal for certain and we hope to bring mass adoption to not only users who are familiar with Celer’s solution, but to the much greater audience where anyone, including those who are not familiar with DeFi yet, to take advantage of DeFi’s high yields without paying the hefty fees when accessing their financial instruments through Layer2.Finance.

Which other main chains integration through cBridge will be available on the launch and which DeFi protocols from those chains are planned for L2F?

Arbitrum, Optimism, Ethereum L2, BSC (Binance Smart Chain) are just a few to start with. We will focus on Ethereum and BSC for DeFi protocol integration for L2F.

Any plans to optimize UI and make it more modern and slick – all for simplicity but could it improve slightly?

Let us know if you know any great designers! We’re open to and appreciate community members helping us do visual designs and ask the community for feedback once we have more samples.

What is the status of the partnership between Celer and Polkadot, is that still going and when will the Polkadot network be finished using Celer as Layer-2?

Yes, the partnership is still ongoing, we are just growing and watching the entire Polkadot ecosystem. L2F will also likely add support for Polkadot when it comes to a mature point for the DeFi ecosystem on Polkadot.

And for sure, Ethereum Virtual Machine (EVM) compatibility is easy to work with, we will prioritize based on the amount of DeFi ecosystem demand.

Is there a pending Parachain auction coming soon?

Yes, however, we are not planning to issue a new token for now and therefore not participating in the auction. To participate, you basically need to have a new token and do the auction through that token. If you have been following the DOT ecosystem, this is basically the drill.

For the next version of L2F, will the GUI be in a similar style?

Yes, similar style, but with mobile compatibility!

A month or so ago you said that the DeFi L2 inflection point would be sometime in July/Aug. Do you still anticipate that and where do you see things going throughout the remainder of 2021?

Yes, this is when L2F v1.0 is online and more and more DeFi strategies are added. This summer is going to be interesting for the entire Ethereum ecosystem, and we are looking forward to making additional key announcements this summer.

I would like to have a place to go back and forth with someone on network participation, learn how others are utilizing what they’ve acquired to pursue main net participation, staking rewards and how can I get more involved with what I am putting my financial weight behind

The best place would be forum.celer.network, We have just set up a community forum this week, and would be a great place to make any proposal and push for a community vote.

What about UniSwap integration?

Providing liquidity pools for Uniswap V3 will be part of the strategy mix for sure. Especially stable token pairs.

Where can we find the latest info on Celer Network?

That would be celer.network, the main page, and then the Technology tab. The website will be updated soon. Additionally, here’s a great source to learn more about our announcements and to get a preview of what’s coming: https://blog.celer.network/

Can you talk a little more about cBridge and what we can expect with that?

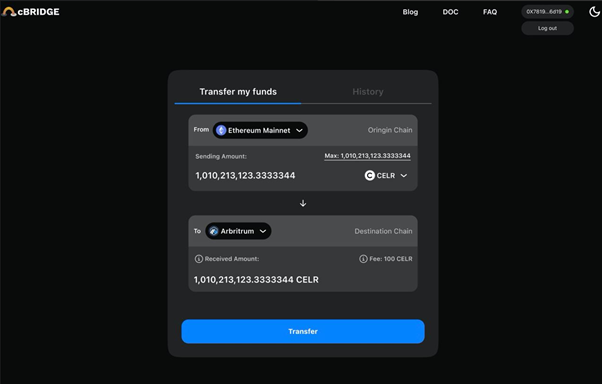

Here’s an image of the UI we’re working on.

It’s very simple to use. You select two chains, pay the fee, get things transferred. And most importantly, ANYONE can run a bridge node and provide liquidity and charge fees to bridge for users. This is just the user-facing portion, but the node will also be open source and can be run by anyone.

This is the first step for cBridge: value transfer. We will move on to call transfer (remote function call from one chain to the other) after this.