CIP-10: cBridge Fee and Pricing Curve Change

Summary

Change the cBridge fee schedule and the pricing curve in order to

- Boost more volume

- Accrue more fee earnings to CELR stakers and LPs

- Reduce slippage when users make transfers and reduce the impermanent loss for LPs

- Achieve a more balanced pool liquidity

Abstract

Improvements to the cBridge fee schedule and pricing curve

Motivation

While cBridge has seen significant growth in volume in the past few months, there are users complaining about the higher fees as compared to some other bridges, which leads to user loss. Moreover, some users suffer from slippage when making cross-chain transfers and LPs may also have an impermanent loss when their liquidity is moved across chains, which impedes the cBridge adoption among users and LPs.

After carefully analyzing the on-chain historical data traces for cBridge, we propose to change the cBridge fee schedule and the pricing curve parameters, in order to boost more volume, accrue more fee earnings, balance pool liquidity, and provide better experiences for users and LPs. We hope cBridge to become the primary go-to bridge for most of the cross-chain traffic.

Proposal

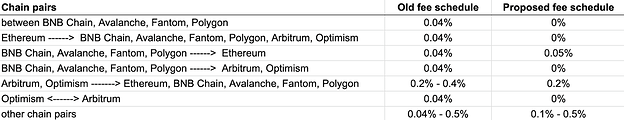

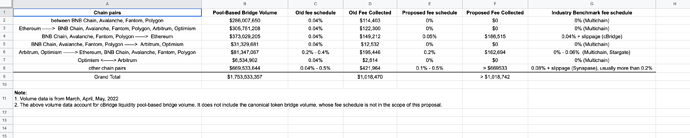

Adjust the percentage fee schedule such that the cBridge fee rates stay competitive for bluechip tokens (e.g., USDC, USDT, ETH) and high-TVL chains (BNB Chain, Polygon, Avalanche, Ethereum).

- Specifically, reduce the fee rate to 0% for some of the most used bridge pairs such USDC/USDT/ETH transfers among BNB Chain/Polygon/Avalanche/Fantom.

- For some of the less-used tokens and chains, the fee rate is slightly raised.

- We expect the overall volume to increase.

- We also expect the overall fee earnings to increase given the higher volume. In fact, the fee schedule is carefully simulated based on the historical cBridge data traces to make sure the overall fee earnings won’t be compromised even under the same volume as today.

- The detailed fee rate change can be found in the following table

Change the cross-chain pricing curve parameters such that there is 0 slippage for the majority of the cross-chain transfers.

Poll

- Yes

- No

0 voters